- #Break even point formula with only fixed and total cost how to

- #Break even point formula with only fixed and total cost series

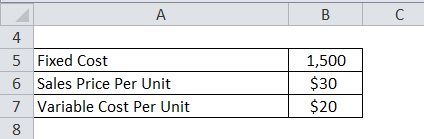

If they decided that they wanted to produce 1,800 units a month, they would have to secure additional production capacity. For example, if a company has the capability of producing up to 1,000 units a month of a product given its current resources, the relevant range would be 0 to 1,000. In other words, fixed costs remain fixed in total over the relevant range and variable costs remain fixed on a per-unit basis. Costs are linear and can clearly be designated as either fixed or variable.

Our CVP analysis will be based on these four (4) assumptions: For example, while we typically assume that the sales price will remain the same, there might be exceptions where a quantity discount might be allowed. However, while the following assumptions are typical in CVP analysis, there can be exceptions. It is important, first, to make several assumptions about operations in order to understand CVP analysis and the associated contribution margin income statement. Those concepts can be used together to conduct cost-volume-profit (CVP) analysis, which is a method used by companies to determine what will occur financially if selling prices change, costs (either fixed or variable) change, or sales/production volume changes.

#Break even point formula with only fixed and total cost how to

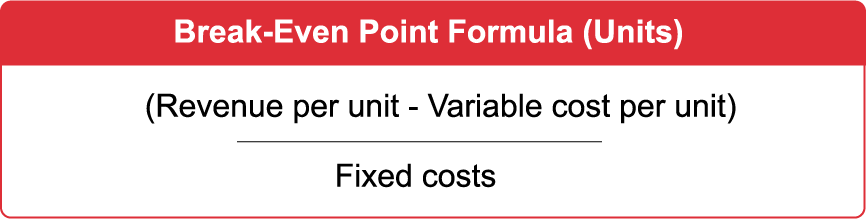

In a previous section, you learned how to determine and recognise the fixed and variable components of costs, and now you have learned about contribution margin. At sales levels below this level (S3), the amount by which the cost line is above the revenue line is loss.Mitchell Franklin Patty Graybeal Dixon Cooper and Amanda White Assumptions required for cost-volume-profit analysis At sales levels above this level (S2), the amount by which the revenue line is above the cost line is profit. The level of sales where the two lines cross (S1) is the breakeven level of sales. The level of cost over this amount is the variable cost at various levels of sales. The cost at zero sales represents the fixed cost. The total cost line shows the total cost at each level of sales. The revenue line shows the total revenue at each level of sales. Revenue and costs are on the vertical axis. The level of sales is on the horizontal axis. As shown below, because we were computing breakeven price, the return over all costs is zero.Ī graphic representation is shown in Figure 1. Next compute the return over variable costs.įinally compute the return over all costs. To prove that the procedure is correct, go through the steps below. However, at higher prices, the product will be more difficult to sell. Notice that the higher the price, the smaller the quantity you will need to sell to break even. Next, divide total fixed cost by each contribution margin to compute the breakeven sales quantity. Select a range of sale prices and compute the contribution margin for each price. The example below helps explain the concept. The breakeven level is the number of units required to be produced and sold to generate enough contributions margin to cover fixed costs. It is the amount of money that the sale of each unit will contribute to covering total fixed costs.

Contributions Margin is the “selling price less the variable costs per unit”, the denominator in the equation above. This can be computed under a range of sale prices with the formula below.Ī key concept of this formula is the Contributions Margin.

#Break even point formula with only fixed and total cost series

One approach is to pick a sale price or a series of sale prices and compute how much of the product you will need to sell at each price to break even.īreakeven sales volume is the amount of your product that you will need to produce and sell to cover total costs of production. To do this you need to classify the costs into the managerial cost categories of variable and fixed costs.

Because fixed costs need to be covered regardless of the number of units produced and sold, the number of units you produce and sell determines the price needed to break even. However, there is not a specific price level that you can charge that will assure you that you will cover your costs. Product price can be based on the cost of producing the product.

0 kommentar(er)

0 kommentar(er)